Limit on investment by bank holding company system in stock of small business investment companies. Company or LLP enjoying certain incentives or tax incentives eg.

What Is An Investment Holding Company And When Is It Useful

2 Act 2014 to the following.

. Pioneer status or investment tax allowance Public Ruling No. Services under section 4a of Bank Holding Company Act. Nova Sdn Bhd closes its account on 31 December every year.

Now his Kingdom Holding investment firm counts Saudi Arabias Public Investment Fund PIF as a minority shareholder and the powerful sovereign wealth fund is unlikely to sit on the sidelines. We look at 4 benefits and 3 drawbacks to see if its suitable for you. 1 For transactions that do not qualify for the.

10 March 2011 Issue. INLAND REVENUE BOARD OF MALAYSIA INVESTMENT HOLDING COMPANY Public Ruling No. On January 30 2020 the Board of Governors of the Federal Reserve System Federal Reserve adopted a final rule for Control and Divestiture Proceedings Final Rule to clarify the Federal Reserves considerations when determining whether a company has the ability to exercise control or a controlling influence under the Bank Holding Company Act of 1956.

102015 Date Of Publication. The first step in applying this percentage test is to determine AOGI by starting with gross income under Sec. 82020 Taxation of a resident individual Part I - gifts or contributions and allowable deductions 4.

Fortunately there are exceptions to registration under the act which issuers can fall under. Public Ruling 12020 - Tax Incentives for Bionexus Status Companies Automation equipment incentives - Investment Allowance and Accelerated Capital Allowance Stamp duty exemption for restructuring or rescheduling of a business loan or financing Labuan entities carrying on pure equity holding activity - Full-time employees requirement. 12020 Tax Incentives for BioNexus Status Companies The IRB has issued PR No.

A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. Public Ruling 102015 InvestmentHolding Company The IRB has issued Public Ruling 102015 Investment Holding Company PR 102015. In addition there are a number of exemptions from registration available to issuer.

On 152009 the tenancy of a major portion of the office lot ends and the. If you have questions dont hesitate to contact us at helpsecgov our online question form or on our toll-free investor assistance line at 800 732-0330. Capital Allowance Industrial Building Allowance and the eligibility to claim against rental income.

The company is an investment holding company IHC. Rental income business is derived from the letting out of office lot in a 4-storey building. Company or LLP without gross business income.

61 and then excluding gains from the sale or disposition of either. Basis Period For Business Non-Business Sources Companies Superceded by Public Ruling No. The Inland Revenue Board IRB has replaced the Public Ruling PR No.

The Investment Company Act of 1940 was created through an act of Congress to require investment company registration and regulate the product offerings issued by. Superseded by the Public Ruling No102015 16122015 - Refer Year 2015. INVESTMENT HOLDING COMPANY Public Ruling No.

View L4 Investment Holding Companiespdf from TAXATION 2423 at Methodist Pilley Institute - Malaysia. To ensure that the public ruling is coherent and valid the Director-General will refer to Section 138A of the Income Tax Act 1967 ITA and its various rules. PR 102015 replaces Public Ruling 32011 PR 32011 on the same subject matter.

1967 a company which is an investment holding listed on Bursa Malaysia is deemed to have gross income from a business source and is eligible for tax treatment under paragraphs 2A or 2D Part 1 Schedule 1 and subparagraph 19A 3 Schedule 3 of ITA 1967. An investment holding company IHC and the process of setting one up in Malaysia has created a lot of buzz. CompanyLLP which does not have gross income from.

Even if an investment adviser is exempt from registration the antifraud provisions of the Advisers Act still apply. An investment holding company IHC means a company whose activities consist mainly in the holding of investments and not less than 80 of its gross income other. 33 Person includes a company a co-operative society a partnership a club an association a Hindu joint family a trust an estate under administration and.

Investment Company Act of 1940. It sets out the interpretation of the Director General of. It is issued mainly to update the contents of PR 32011 due to amendments made via Finance No.

Lecture 4 Investment holding company And Investment dealing company Public ruling 102015 Date of. Investment Holding Company by inserting additional explanations to paragraph 10. The income requirement is met if at least 60 of the corporations adjusted ordinary gross income AOGI for the tax year is personal holding company income PHCI.

A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. 16 December 2015 Page 8 of 23 SNSB is an IHC for the years of assessment 2011 and 2012 since its main activity is the holding of investments and not less than 80 of SNSBs gross income is from the holding of those investments. 82014 dated 1 December 2014 - Refer Year 2014.

The above New Public Ruling can be viewed and downloaded from the IRBs website at the. A Page 6 of 25 Example 6. It sets out the interpretation of the Director General in.

Indirect control of small business concern through convertible debentures held by small business investment company. The Investment Company Act and rules thereunder require each fund to transmit a report to its shareholders semi-annually. A bank holding company proposing to engage in permissible nonbanking activities either de novo or through the acquisition of an existing company must provide prior notice to the Federal Reserve if the bank holding company and the proposal meet the criteria in section 22523 c of Regulation Y.

SECURITIES EXCHANGE ACT OF 1934 PUBLIC UTILITY HOLDING COMPANY ACT OF 1935 INVESTMENT COMPANY ACT OF 1940 INVESTMENT ADVISERS ACT OF 1940 AND ENERGY POLICY AND CONSERVATION ACT OF. Investment holding companies not listed on BURSA Malaysia with profit from rent income subject to section 60F of the Income Tax Act 1967 ITA shall no longer be eligible for tax treatment under Paragraph 2A Part 1 of. Section 3 c 1 of the act excepts from the definition of investment company any issuer whose outstanding securities other than short-term paper are.

Pershing Square Holdings Bill Ackman Annual Investor Update Presentation Otcmkts Pshzf Seeking Alpha

File Your T5 On Time To Maximize Your Return On Investment Shajani Llp Chartered Professional Accountants Advisors

What Is An Investment Holding Company And When Is It Useful

What Is An Investment Holding Company And When Is It Useful

What Is Investment Holding Company Ihc Anc Group

What Is An Investment Holding Company And When Is It Useful

Establishing A Holding Company In Malaysia What Is Holding Company

Investment Holding Company Ihc Vs Private Ownership Po Hills Cheryl

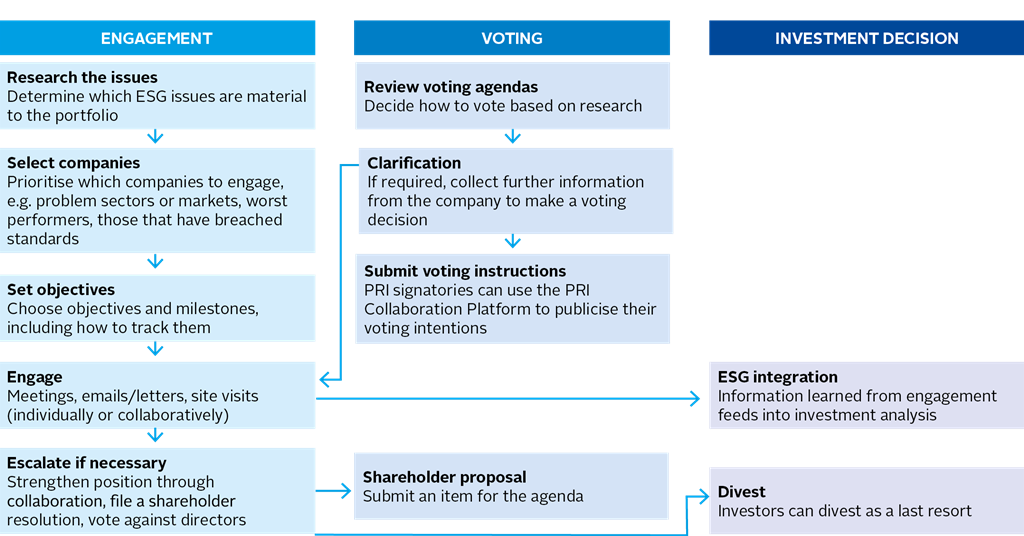

An Introduction To Responsible Investment Listed Equity Introductory Guide Pri

Investment Holding Company Determination Of Gross Income Of A Company Or Limited Liability Partnership Cheng Co Group

What Is Investment Holding Company Ihc Anc Group

What Is An Investment Holding Company And When Is It Useful

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

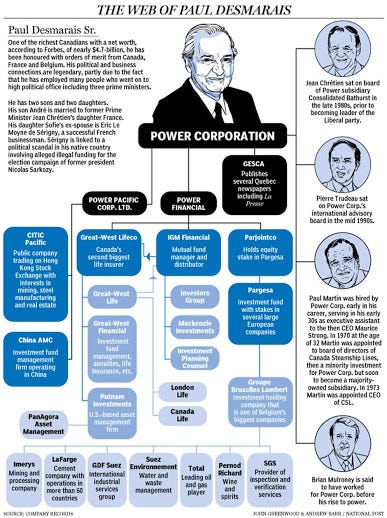

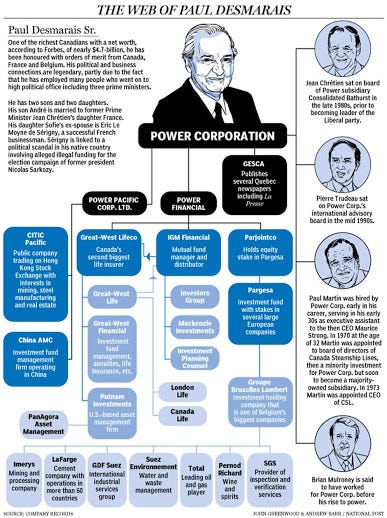

The Corrupt Legacy Of Paul Desmarais Special Edition By American Idealism Medium

What Is An Investment Holding Company And When Is It Useful

What Is Investment Holding Company Ihc Anc Group

Starting A Real Estate Holding Company Fortunebuilders

Establishing A Holding Company In Malaysia What Is Holding Company